Here, you will find notes, questions, solutions, textual answers, pdfs, and extras of the theoretical and practical questions of all the chapters of NBSE class 9 bookkeeping for students studying under the Nagaland Board of School Education (NBSE). However, these notes should be used only for references and additions/modifications should be made as per the requirements.

NOTE: Practical solutions are not available at the moment

- Chapter 1: Introduction to Book Keeping and Accountancy, NBSE Class 9 Bookkeeping

- Chapter 2: Basic Accounting Concepts, NBSE Class 9 Bookkeeping

- Chapter 3: Source Documents and Accounting Equation

- Chapter 4: Rules of Debit and Credit – Journal, NBSE Class 9 Bookkeeping

- Chapter 5: Ledger Accounts, NBSE Class 9 Bookkeeping

- Chapter 6: Cash Book, NBSE Class 9 Bookkeeping

- Chapter 7: Trial Balance, NBSE Class 9 Bookkeeping

Chapter 1: Introduction to Book Keeping and Accountancy, NBSE Class 9 Bookkeeping

Introduction to Book Keeping and Accountancy: If you are running a business, you need to keep records of everything you are buying or selling. Keeping records of the transactions happening day-to-day helps you to understand if you are making any progress in the business or if are you suffering losses at the end of the day. Bookkeeping basically means keeping records of all the transactions. Bookkeeping is the first step of keeping records. Accountancy, on the other hand, can be defined as the art of classifying the data already recorded into different sections while maintaining specific guidelines which are the same everywhere in the world and interpreting the transactions in a systematic manner so as to come to a conclusion related to the progress of the business and planning the future. Both bookkeeping and accountancy are related. Bookkeeping is like going to the market and buying vegetables, but accountancy is the art of cooking the purchased vegetables.

Chapter 2: Basic Accounting Concepts, NBSE Class 9 Bookkeeping

Basic Accounting Concepts: Basic Accounting Concepts may be defined as a set of predefined rules and technicalities which every business needs to follow so that the way a business maintains its books is easily understood by everyone without any confusion. Every company or business in the world decides to maintain their books of accounts in their own way, which will lead to confusion as not everyone will be able to read everyone else’s books of accounts. Businesses need to make their financial information available to a number of individuals and bodies like the government, employees, investors, etc. Therefore, all businesses must make their books of accounts in such a way that everyone is able to understand. This is done by keeping in mind some defined guidelines, which are called Generally Accepted Accounting Principles. These principles are the same in the world for every company.

Chapter 3: Source Documents and Accounting Equation

Source Documents and Accounting Equation: Source documents, as the name suggests, are documents that act as evidence of business transactions taking place. In accountancy, transactions cannot be recorded in the books of accounts until and unless there are supporting documents of their taking place. These documents contain the nature, date, amount, and parties involved. If the documents are available, the records can be made. These documents are called “source documents.” For example, cash memos, receipts, invoices, etc. The accounting equation, on the other hand, is a mathematical expression that shows that the assets of a business are always equal to the total of the liabilities and the capital.

Chapter 4: Rules of Debit and Credit – Journal, NBSE Class 9 Bookkeeping

Rules of Debit and Credit – Journal: In this chapter, Rules of Debit and Credit-Journal, you will learn how to record a transaction initially and what should be classified as debit and what should be classified as credit. Basically, every transaction has two aspects, which are debit and credit. If you go to the market and buy a packet of biscuits from a shop, you are making a transaction in which two parties are involved—you and the shopkeeper. For you, you have gained a packet of biscuits, but at the same time, you have lost some money. Similarly, for the shopkeeper, two things are happening: he is gaining money but losing a packet of biscuits. As you can understand, every transaction has two faces—in one something is gained and in the other something is lost. Journals are the first books in which transactions are recorded and are also called books of original entry. Every journal entry carries a debit entry and a credit entry and is supported by a narration that explains the transaction in readable sentences.

Chapter 5: Ledger Accounts, NBSE Class 9 Bookkeeping

Ledger Accounts: In the book of journals, transactions are recorded according to the dates in chronological order. But if you want to get information about a particular account, say, the sales account, you will have to read out all journal entries and keep on counting them every time you come across an entry that impacts the sales account. This is a very time-consuming process. That is why after the journal entry, the transactions are recorded in ledger accounts. A ledger book contains a number of ledger accounts and each ledger account records transactions related to a particular subject like assets, liabilities, capital etc. The ledger accounts are prepared by transferring the transactions from the journal entries. The ledger accounts make it easier to get quick information about any particular account.

Chapter 6: Cash Book, NBSE Class 9 Bookkeeping

Cash Book: Cash books are books of accounts in which only cash transactions are recorded. A cash book is a necessity in a business because the transactions related to cash are large in numbers. By going through the cash book, one is able to understand how much cash is available with the business and what is the true position of cash transactions. In this chapter, you will learn how to prepare a cash book. We need to keep in mind the fact that if there is a credit transaction, it cannot be recorded in a cash book as the name suggests.

Chapter 7: Trial Balance, NBSE Class 9 Bookkeeping

Trial Balance: As we already know that every transaction has two faces, when we transfer the transactions from the journal to the ledger, we need to make sure that all the transactions are recorded twice in the ledger. To do that, we prepare a statement called a trial balance. In the trial balance, we put all the debit balances of the ledger accounts on the debit side of the trial balance and all the credit balances of the ledger accounts on the credit side of the trial balance. Once we have transferred all the balances of the ledger accounts to the trial balance, both the credit and debit sides should show the same amount. If we arrive at different balances, we need to be assured that we have made mistakes in recording the transactions.

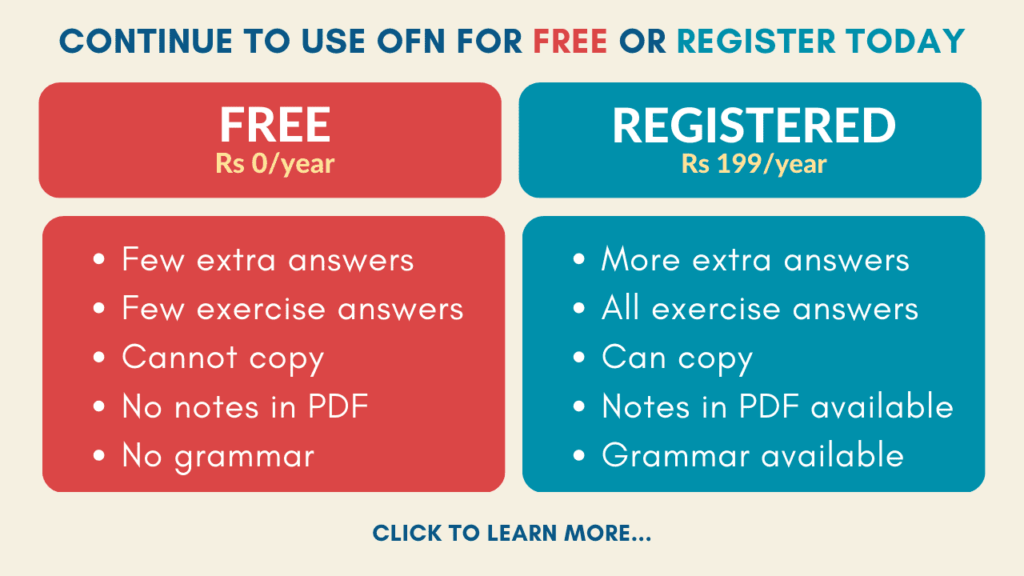

Download all chapters in PDF (only for registered users)

Get notes of other classes or subjects

Please provide practical too

When will practical notes be available?

Practical?