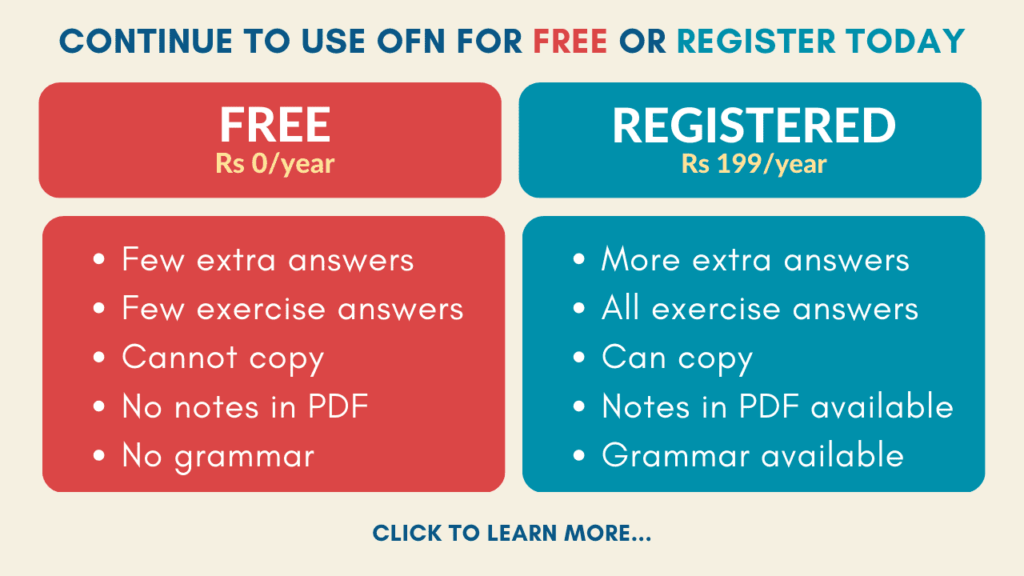

Here, you will find summaries, questions, answers, textbook solutions, pdf, extras etc., of (Nagaland Board) NBSE Class 12 (Arts/Commerce) Economics Part II Chapter 3: Structural Changes. These solutions, however, should be only treated as references and can be modified/changed.

Introduction

India’s journey towards becoming a global economic powerhouse has been marked by significant strides in its industrial sector. The evolution of this sector has been instrumental in shaping the country’s economic landscape, driving growth, and enhancing the nation’s global competitiveness.

The industrial sector’s importance is underscored by its role in fostering innovation and technological advancement. The deregulation of industries since the 1990s has opened up the sector to private enterprises, fostering a competitive environment that has spurred innovation. This deregulation has also led to the influx of foreign capital, bringing with it advanced technologies and management techniques that have further propelled the sector’s growth.

Moreover, the industrial sector has been a key driver of employment in India. The establishment of production and trading units by foreign companies has created numerous job opportunities, contributing to the country’s socio-economic development. This has been complemented by the growth of the service sector, which has seen significant improvements in areas such as telecommunications, insurance, and banking, thanks to the entry of foreign companies.

The industrial sector has also played a pivotal role in the development of India’s capital market. The influx of foreign direct investment and portfolio investment has not only boosted the sector’s growth but also enhanced the country’s financial stability.

Furthermore, the industrial sector’s growth has had a ripple effect on other sectors of the economy. The increase in industrial production has led to an expansion of the market, enabling Indian businesses to extend their reach globally.

However, the journey is far from over. The sector continues to face challenges such as the need for further technological advancement, the requirement for skilled labor, and the need for sustainable and inclusive growth. Addressing these challenges will be crucial for the sector to continue playing its pivotal role in India’s economic development.

Video tutorial

Textual questions and answers

A. Very short-answer questions

1. When was the New Economic Policy introduced?

Answer: The New Economic Policy was introduced in 1991.

2. Mention any two causes for the economic crisis of 1991 in India.

Answer: Two causes for the economic crisis of 1991 in India were:

- Poor performance by public sector undertakings (PSUs) – The performance of most PSUs was dismal, acting as a drag on economic growth rather than driving industrialization.

- Increasing debt burden – Government expenditure was much higher than revenue, leading to high fiscal deficits.

3. Define balance of payments.

Answer: Balance of payments is the account of a country’s imports and exports of all items of trade.

4. What are ‘remittances’?

Answer: Remittances are the foreign currency transferred by those working abroad to their families back in their own country.

5. Give one effect of inflation in an economy.

Answer: One effect of inflation in an economy is that all commodities become very costly and the value of money falls.

6. What is ‘liberalisation’ of the economy?

Answer: Liberalisation is the removal or reduction of various types of controls and restrictions, which are in force in the economy, in order to allow trade and industry to function more freely.

13. Name any two private banks in India.

Answer: Any two private banks in India are ICICI and HDFC.

14. If previously Rs 40 is exchanged for 1$ and now Rs 45 is exchanged for 1$, will this be termed as devaluation of the rupee or the dollar?

Answer: This will be termed as devaluation of the rupee.

15. Give two sectors which the government must develop in India.

Answer: Two sectors the government must develop in India are education and health.

B. Short-answer questions-I

1. What was the immediate crisis that India faced in the beginning of the 90s decade?

Answer: The immediate crisis that India faced in the beginning of the 90s decade was the Gulf crisis in 1990 when Iraq invaded Kuwait. This led to a sharp rise in the price of crude oil which adversely affected the Indian economy. By the middle of 1991, India did not have enough foreign exchange reserves to pay for even two weeks of imports.

2. Explain the debt situation of India in 1991.

Answer: In the decade of 1980-90, the government had outlived its means; expenditure was much higher than revenue. This had led the government to raise revenue from domestic sources and borrow from the rest of the world. The government had already borrowed heavily from the rest of the world. This raised the burden of repayment of principal and of the interest on loans. Non-performance of the public sector failed to raise the revenue needed to pay back the interest, let alone the principal. Therefore, the economy faced a deteriorating fiscal situation.

3. State the features of the New Economic Policy which was introduced in India in 1991.

Answer: The main features of the New Economic Policy introduced in India in 1991 are:

- Liberalisation: The government lifted restrictions on the private sector and removed barriers to entry for foreign businesses.

- Privatisation: The government reduced its role in many areas of business, allowing private companies to take over.

- Globalisation: The government opened up the Indian economy to foreign trade and investment.

4. Explain the need for delicensing of Indian industries in 1991.

Answer: The need for delicensing of Indian industries in 1991 was due to the following reasons:

- To promote industrial growth and investment.

- To remove unnecessary bureaucratic control over industries.

- To increase competitiveness of Indian industries.

- To attract foreign investment.

- To make Indian industries globally competitive.

- To promote balanced regional development.

- To remove restrictions on the movement of goods and services.

5. Give any three measures introduced in 1991 to reform the industrial sector in India.

Answer: The three measures introduced in 1991 to reform the industrial sector in India were:

- Abolition of industrial licensing: This was done to promote ease of doing business and encourage entrepreneurship.

- Openness to foreign direct investment: This was done to attract foreign capital and technology into India.

- Market-friendly policies: The government introduced policies that were conducive to market forces and competition.

6. How were the fiscal reforms able to increase the net tax?

Answer: The fiscal reforms undertaken in 1991 were aimed at increasing the net tax revenue for the government. The steps taken were:

- Tax reforms: Both direct taxes (like income tax, wealth tax) and indirect taxes (like sales tax, customs duties) were reduced. The aim was to increase tax compliance by simplifying procedures and reducing rates. This increased the tax net.

- Sale of PSUs: The government sold its stake in some PSUs to the private sector through disinvestment. The funds raised added to government revenue.

- Reduction in expenditure: The government tried to cut down unnecessary expenditure to reduce the need for borrowings and improve its fiscal situation.

10. What benefits does India derive from outsourcing?

Answer: The benefits India derives from outsourcing are:

- Earning of foreign exchange through export of services like call center, software services, etc.

- Employment generation in the services sector like IT, BPO, etc.

- Growth of services sector and its contribution to GDP.

- Technology and knowledge transfer to Indian workforce.

11. Give three arguments in favour of globalisation.

Answer: Three arguments in favour of globalization are:

- Access to larger markets globally for Indian companies to sell goods and services.

- The inflow of advanced foreign technologies and management practices.

- Increase in foreign capital inflows like FDI and FII for investment and growth.

- The competitiveness of Indian companies increases against global peers.

C. Short-answer questions-II

1. Discuss the problems faced by India in the year 1991.

Answer: The immediate crisis that India faced in the beginning of the 90s decade was a precarious default situation. To avert this, India had to liquidate its stock of gold for foreign exchange and seek emergency assistance from donor countries. The International Monetary Fund (IMF) agreed to advance special loans on condition that the Indian government initiates certain reforms in the country. This led to the introduction of the New Economic Policy as the only way out of the economic crisis.

2. Explain any two features of the NEP, 1991.

Answer: Liberalisation: This is the removal or reduction of various types of controls and restrictions, which are in force in the economy, in order to allow trade and industry to function more freely. Measures adopted under liberalisation included industries being free to expand and produce, Indian industries being free to buy machines and raw materials from foreign industries, relaxation under the Monopolies Act, and the simplification of import and export policies.

Fiscal Policy Reforms: The NEP took steps to control the poor fiscal situation in the country. Tax reforms were aimed at reducing the tax rates and increasing the tax net. Both direct and indirect taxes were reduced. The complicated procedure was also simplified for greater tax compliance. The government also made an attempt to reduce its expenditure. Unnecessary expenditure was cut down, so it would have to borrow less from the public. Certain loss-making PSUs were to be shut down or sold to private investors.

3. How did the MRTP Act contain industrial growth? Give the steps taken to remove these hurdles.

Answer: The MRTP Act was enacted to prevent concentration of economic power, provide for control of monopolies, and protect consumer interest. However, it ended up creating hurdles for industrial growth by imposing restrictions on capacity expansion, establishment of new undertakings, merger, amalgamation and takeover, and inter-corporate investments.

To remove these hurdles, the Act was amended in 1991, removing the need for prior approval for capacity expansion, allowing establishment of new undertakings, and removing restrictions on mergers, takeovers, and inter-corporate investments.

4. Discuss the reforms introduced in the financial sector in India under the NEP, 1991.

Answer: The major financial sector reforms introduced under the New Economic Policy in 1991 include:

Interest rate reforms: Earlier, the Reserve Bank of India (RBI) used to decide the interest rates on deposits and loans for banks. Under the reforms, banks were given freedom to decide interest rates based on market conditions. This benefited both banks and consumers.

Allowing private banks: Before 1991, most banks were owned by the RBI or the government. The reforms allowed entry of private banks like ICICI, HDFC, etc. This increased competition in the banking sector.

Permission for foreign investment: Foreign direct investment limit in banks was raised to 50%. Foreign institutional investors like merchant bankers, mutual funds, etc were allowed to invest in Indian markets. This brought in more funds and expertise.

9. Give two merits and two demerits of globalisation.

Answer: Merits of globalisation:

- Technological development: Globalisation has enabled the inflow of foreign technology, which is very superior and advanced. Now Indian business units use this modern technology.

- Development of capital market: Many foreign investors invest in the Indian capital market. Recently there has been a substantial increase in the inflow of foreign direct investment and portfolio investment.

Demerits of globalisation:

- Unemployment: Foreign companies operating in India use capital-intensive technology. Even some Indian companies use imported capital-intensive technology.

- Exploitation of Labour: Globalisation is exploiting unskilled workers by giving lower wages, less job security, and long working hours.

10. Briefly discuss the features of LPG.

Answer: Liberalisation refers to the removal of controls and restrictions in various sectors of the economy. Privatisation refers to reducing the role of the public sector and encouraging private sector participation through disinvestment, shutting down loss-making PSUs, and allowing private competition even in reserved areas earlier. Globalisation refers to integrating the Indian economy with the rest of the world. This exposed the Indian economy to global markets and competition.

The LPG regime replaced the previously controlled LQP (Licence-Quota-Permit) regime with the aim to improve productivity, efficiency and international competitiveness of the Indian economy. LPG promoted market principles and private enterprise.

However, LPG also led to some criticisms such as job losses, income disparities, regional imbalances, environmental issues etc. due to over-reliance on market forces and private profit motives. Thus a balance is needed.

D. Long-answer questions-I

1. What are the major factors responsible for the high growth of the service sector?

Answer: Some of the major factors responsible for the high growth of the service sector in India are:

- Rapid growth in communication services like telecom, internet etc. due to technological advancements and reforms in the telecom sector.

- Expansion of financial services like banking, insurance, stock markets etc. aided by reforms undertaken in the financial sector.

- Growth in export-oriented services like IT, BPO, KPO due to high skilled manpower available at competitive costs.

- Increased outsourcing of services to India like call centers, business process outsourcing, knowledge process outsourcing etc.

- Rising incomes and demand in the domestic economy, leading to growth in services like tourism, hospitality, media & entertainment.

- Young demographics and availability of English speaking workforce which enabled growth of outsourcing industry in India.

2. Agricultural sector appears to be adversely affected by the reform process. Why?

Answer: The agricultural sector appears to have been adversely affected by the reform process in India for the following reasons:

- Reduction in import restrictions led to a surge in cheaper imports which adversely affected the domestic agricultural sector. This affected farmers’ income.

- Removal of fertilizer subsidies burdened the farmers with high input costs. This made farming less remunerative.

- Shift away from the priority given to agriculture earlier during the controlled regime reduced public investment in agriculture.

- Focus on industrial and services sector growth led to diversion of resources away from agriculture.

- Decline in public extension work in agriculture reduced access of farmers to modern technology and irrigation.

- Reduction in food subsidies and the PDS made farmers more vulnerable to price fluctuations.

3. Why did the industrial sector perform poorly in the reform period?

Answer: From 1950 to 1990, the public sector in India had not been able to perform as envisaged while the private sector recorded considerable growth even in an unfavourable environment.

Rather than being a vehicle for faster industrialisation, many of the PSUs proved to be a drag on economic growth. They had been recording losses for a long time and the government had to go on supporting them with funds. The private sector, though performing better, was underdeveloped due to the many restrictions imposed and together this resulted in the low productivity of industries.

The Indian economy could no longer grow in isolation. The protection of Indian industries was no longer contributing to economic growth. India had to encourage international competitiveness by (i) improving the efficiency of Indian industries and (ii) attracting modern and better technology.

Liberalisation and globalisation have opened new frontiers for Indian entrepreneurs. Indian entrepreneurs are becoming transnational and many such as the TATA are on a fast track to acquiring foreign businesses. Indian Business Process Outsourcing (BPO) companies are already gaining prominence and earning precious foreign exchange.

4. Discuss the economic reforms in India in the light of social justice and welfare.

Answer: Economic growth has failed to be sufficiently inclusive, particularly after the mid-1990s. Agriculture lost its growth momentum from that point on and subsequently entered a near-crisis situation. Jobs in the organised sector have not increased despite faster growth. The percentage of our population below the poverty line is declining but only at a modest pace. Malnutrition levels also appear to be declining, but the magnitude of the problem continues to be very high.

Far too many people still lack access to basic services such as health, education, clean drinking water and sanitation facilities without which they cannot claim their share in the benefits of growth. Women have increased their participation in the labour force as individuals, but continue to face discrimination and are subject to increasing violence, one stark example of which is the declining child sex ratio.

In 2005, the government created National Investment Fund. Proceeds of disinvestment are credited to this fund and are utilised to finance social sector schemes related to health, education, employment, etc.

7. Discuss globalisation stating its features, merits and demerits.

Answer: Globalisation is the integration of the economy with the world economy through free trade and the free movement of capital.

Features of globalisation:

- The limit of foreign Capital investment has been raised.

- Foreign trade policy was enforced for a longer duration, that is, for five years. The present trade policy of India is a liberal policy.

- To gain maximum international benefits, customs duties and taxes imposed on imports and exports are being reduced gradually.

Merits of globalisation:

- Technological development: Globalisation has enabled the inflow of foreign technology, which is very superior and advanced. Now Indian business units use this modern technology.

- Development of capital market: Many foreign investors invest in the Indian capital market. Recently there has been a substantial increase in the inflow of foreign direct investment and portfolio investment.

- Increase in Foreign Exchange Reserves: As a result of globalisation of Indian economy, foreign exchange reserves have also increased substaintially.

Demerits of globalisation:

- Unemployment: Foreign companies operating in India use capital-intensive technology. Even some Indian companies use imported capital-intensive technology.

- Exploitation of Labour: Globalisation is exploiting unskilled workers by giving lower wages, less job security, and long working hours.

- Increase in Inequalities: Globalisation has increased inequalities in our economy, Globalisation has benefitted MNCs and big industrial units but small and cottage industries are adversely hit by it.

E. Long-answer questions-II

1. Describe the economic crisis that engulfed India in 1991. What led to such a situation?

Answer: The economic crisis that engulfed India in 1991 was a result of a precarious default situation that left India with no option but to liquidate its stock of gold for foreign exchange. Emergency assistance from donor countries was sought and the International Monetary Fund (IMF) was approached for borrowing under special facilities. The IMF agreed to advance special loans on condition that the Indian government initiates certain reforms in the country. This finally led to the New Economic Policy as the only way out of the economic crisis.

The economic crisis that engulfed India in 1991 was triggered by several factors:

- Poor Performance of Public Sector Undertakings (PSUs): Many of the PSUs were recording losses for a long time and the government had to support them with funds. Rather than being a vehicle for faster industrialization, many of the PSUs proved to be a drag on economic growth.

- Inflationary Pressures: The rate of inflation reached double figures (10.3 per cent in 1990-91). A cause for concern was the rising price of food. Usually, rising prices are followed by the workers demanding higher wages, which, if granted, leads to a further rise in prices.

- Increasing Debt Burden: In the decade of 1980-90, the government had outlived its means; expenditure was much higher than revenue. This had led the government to raise revenue from domestic sources and borrow from the rest of the world.

- Fragile Balance of Payments Position: India’s imports soared despite the heavy duties and quotas. Exports, on the other hand, did not rise as expected due to non-competitive quality and high price of Indian goods in the international market. This led to a big gap between the demand and supply of foreign currency.

- Gulf Crisis: Towards the end of 1990, Iraq invaded Kuwait and the Gulf crisis that occurred thereafter adversely affected the Indian economy in a major way. The resultant rise in price of crude oil erupted as a major crisis in the Indian economy.

2. The New Economic Policy was the only way out for India in 1991. Analyse this statement in the light of the available facts.

Answer: The 1991 economic crisis in India led to the implementation of the New Economic Policy (NEP). The NEP was a response to the IMF’s condition for special loans, which required India to initiate certain reforms. The NEP introduced significant changes in industrial, trade, fiscal, and monetary policies, replacing the license, quota, and permit (LQP) system with a regime of liberalization, privatization, and globalization (LPG).

Under the NEP, industries were given freedom to expand and produce, import and export policies were liberalized, and the government simplified tax procedures while reducing tax rates. The fiscal policy reforms aimed to increase revenue and curtail expenditure, leading to a reduction in government borrowing.

The role of the State also changed from being a controller and regulator to a facilitator of private investment and development. This shift in the State’s role, along with the other reforms under the NEP, was crucial in navigating India out of the 1991 economic crisis.

3. How was the New Industrial Policy, 1991 a major deviation from the IPR 1956?

Answer: The New Industrial Policy of 1991 marked a significant deviation from the Industrial Policy Resolution of 1956 in several ways:

- Removal of Size Restrictions: The New Industrial Policy of 1991 abolished the asset limit for large industries, which was previously set by the Monopolies and Restrictive Trade Practices Act. This allowed for the expansion and modernization of private industries.

- Reduction in Reserved Industries: The number of industries reserved for the public sector was reduced from 17 (as per the 1956 policy) to 8 in 1991, and now only 3 industries are reserved. This process, known as dereservation, opened up more sectors for private investment.

- Encouragement of Foreign Capital: The 1991 policy liberalized foreign investment rules, allowing foreigners to invest up to 100% of the total capital in Indian industries, attracting new technology and management techniques into India.

4. Explain the changing role of the State in the Indian economy since 1991.

Answer: The role of the State in the Indian economy has undergone a significant transformation since the introduction of the New Economic Policy in 1991. Here are the key changes:

- Less Participation as a Producer: The government reduced its active role in production with deregulation, delicensing, and disinvestment. In the first four decades of planning since Independence, the government had its hand in almost every sector. This active role has been significantly reduced since 1991.

- Regulatory Role: From 1947-1990, various regulations and laws were passed to control industries and trade. The New Economic Policy revised this role of the state by doing away with these laws. However, with more activities being market-driven, there is a need to safeguard the consumer by regulating the private sector.

- As a Facilitator: The government has actively and successfully developed the infrastructure in India. Now, the state has to facilitate the private sector by following more liberal policies.

- Services Sector: Services have recorded a. more consistent growth. There has been an upsurge in industry-related services such as insurance, financing, real estate_ang business services, especially outsourcing services.

- Fiscal Deficits: Tax evasion was expected to be curbed and to fill the gap in the government budget. However, it is still high despite lower taxes. Tariff reduction with the aim of attracting foreign investment has further reduced the government’s revenues. This has limited public expenditure in social sectors: a disturbing manner to curtail public expenditure.

- Employment and Inequality: Growth has neither generated employment not has it reduced the rising inequality, As a result, a large proportion of the population is deprived and excluded from the fruits of development even though economic growth has increased.

8. Explain how globalisation moulded the picture of development in India.

Answer: Globalisation has significantly shaped the development landscape in India in several ways:

- Increase in Foreign Collaboration: Foreign collaboration agreements, both technical and financial, have increased. Foreign companies have set up many enterprises in India in collaboration with Indian companies.

- Increase in Foreign Exchange Reserves: As a result of the globalisation of the Indian economy, foreign exchange reserves have also increased substantially.

- Technological Development: Globalisation has enabled the inflow of foreign technology, which is very advanced. Now Indian business units use this modern technology.

- Development of Service Sector: With the entry of foreign companies, tremendous improvement has been witnessed in various services like telecommunication, insurance, banking, etc.

- Development of Capital Market: Many foreign investors invest in the Indian capital market. There has been a substantial increase in the inflow of foreign direct investment and portfolio investment.

- Increase in Employment: Foreign companies are establishing their production and trading units in India, which has increased employment opportunities for Indians.

9. Explain the importance of industrial sector in India.

Answer: The industrial sector holds significant importance in India due to the following reasons:

- Deregulation of Industries: At present, only six industries require permission from the State. All other industries have been thrown open to the private sector. Delicensing was a step towards liberalising industries from government controls and regulations.

- Encouragement to Foreign Capital: Before 1991, the government was more restrictive towards foreign investment in India. At present, foreigners can invest up to 100% of the total capital. This has attracted low-cost modern management techniques and marketing expertise and new technology into India.

- Development of Capital Market: Many foreign investors invest in the Indian capital market. There has been a substantial increase in the inflow of foreign direct investment and portfolio investment.

- Increase in Industrial Growth Rate: Privatisation promotes industrialisation. It further creates employment, boosts industrial production, and promotes export.

- Increase in Employment: Foreign companies are establishing their production and trading units in India, which has increased employment opportunities for Indians.

- Development of Service Sector: With the entry of foreign companies, tremendous improvement has been witnessed in various services like telecommunication, insurance, banking, etc.

Additional/extra questions and answers

Coming soon

Additional/extra MCQs

Coming soon

Get notes of other boards, classes, and subjects