Here, you will find summaries, questions, answers, textbook solutions, pdf, extras etc. of (Nagaland Board) NBSE Class 12 (Arts/Commerce) Economics Chapter 2: Circular Flow of Income. These solutions, however, should be only treated as references and can be modified/changed.

Introduction

The concept of the circular flow of income is a fundamental principle in economics, illustrating the continuous movement of goods, services, and money among different sectors of the economy. This flow is circular in nature because it moves in a cycle, returning to its starting point, with no defined beginning or end.

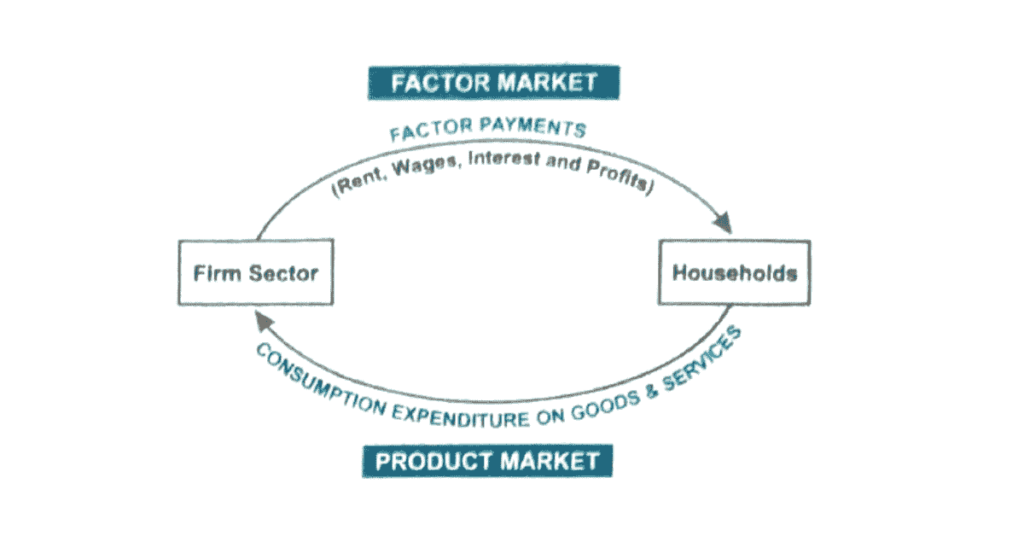

In a simplified model involving two sectors – the household sector and the firm sector – the circular flow of income becomes evident. Firms hire or purchase factor services from households, which are owners of factors of production such as land, labour, capital, and enterprise. By coordinating these factors, firms produce goods and services, thereby generating income. Households, as the recipients of this income, in turn, spend their earnings on goods and services produced by firms to satisfy their wants. This consumption expenditure by households forms a reverse flow of income, going back to the firms, completing the circular flow of income.

This circular flow of income and product is based on two fundamental principles. First, in any exchange process, the seller or producer receives the same amount that the buyer or consumer spends. Second, goods and services flow in one direction, and the money payment to acquire them flows in the reverse direction, giving rise to a circular flow. Thus, the product flow from the seller to the buyer is necessarily a complement of the money or income flow from the buyer to the seller.

In modern economies, all exchange activities take place through money, making it the medium of exchange. This leads to the concept of real flows and money flows. Real flows refer to the flows of actual goods and services. For instance, when factor services flow from households to firms, and when goods and services flow from firms to households, these are considered real flows. On the other hand, money flows refer to the flow of factor payments and payments for goods and services between households and firms. These flows of money facilitate various transactions, moving from one sector to another.

Textual questions and answers

A. Very short-answer questions (answer in one word/one sentence)

1. Define flow.

Answer: A flow refers to change in magnitude of a variable over time.

2. Define real flow.

Answer: Real flows refer to the flows of goods and services.

3. What do you mean by money flow?

Answer: Money flows refer to the flows of money in the form of factor payments and consumption expenditure.

B. Short-answer questions-I (answer in 30-50 words)

1. What is circular flow of income?

Answer: Circular flow of income refers to continuous circular flow of goods, services and money among different sectors of economy. Flow of money is the aggregate value of goods and services either as factor payment or as expenditure on goods and services.

2. Name the two basic principles of circular flow of income.

Answer: The circular flow of income involves two basic principles: (i) In any exchange process, the seller (or producer) receives the same amount which the buyer (or consumer) spends. (ii) Goods and services flow in one direction and the money payment to acquire them, flows in the reverse direction giving rise to a circular flow.

C. Short-answer questions-II (answer in 60-80 words)

1. Define circular flow of income. Discuss the principles of it.

Answer: The circular flow of income refers to the continuous circular flow of goods, services, and money among different sectors of the economy. It involves two basic principles: (i) In any exchange process, the seller (or producer) receives the same amount which the buyer (or consumer) spends. (ii) Goods and services flow in one direction and the money payment to acquire them, flows in the reverse direction giving rise to a circular flow.

2. What is real flow? Give examples.

Answer: Real flow refers to the flows of goods and services. These are real because they consist of actual goods and services.

For instance, when factor services (services of land, labour, capital, enterprise) flow from households to firms which require them for producing goods and services, these are called real flows. Similarly, when goods and services produced by firms flow from producing enterprises to households who buy them for satisfying their wants, these are also real flows.

4. Define income flows.

Answer: Income flows refer to the flow of money in the form of income and expenditure among different sections of the society. It is money that facilitates various transactions, bringing flows of money from one sector to another. When factor incomes (rent, wages, interest, and profit) flow from firms to households as rewards for their factor services, these are called income flows. Similarly, when households spend their incomes on the purchase of goods and services and as a result, money flows back to firms, these also indicate income flows.

D. Long-answer questions-I (answer in 90-120 words)

1. Distinguish between real flows and money flows.

Answer: All the flows in an economy can be classified into Real Flows or Money Flows. Real flows refer to the flows of goods and services. These are real because they consist of actual goods and services. When factor services (services of land, labour, capital, enterprise) flow from households to firms which require them for producing goods and services, these are called real flows. Similarly, when goods and services produced by firms flow from producing enterprises to households who buy them for satisfying their wants, these are also real flows.

Money flows, on the other hand, refer to the flow of factor payments and payments for goods and services between households and firms. These refer to the flows of money in the form of factor payments and consumption expenditures. When factor incomes (rent, wages, interest and profit) flow from firms to households as rewards for their factor services, these are called money flows. Similarly, when households spend their incomes on the purchase of goods and services and as a result, money flows back to firms, these also indicate money flows.

2. How are income flows and product flow equal? Explain with a diagram.

Answer: Income flows and product flows are equal. The circular flows in the economy prove that income flows in the form of factor income and consumption expenditure, and product flows in the form of factor services and final goods and services are equal.

The circular flow of income involves two basic principles:

(i) In any exchange process, the seller (or producer) receives the same amount which the buyer (or consumer) spends.

(ii) Goods and services flow in one direction and the money payment to acquire them, flows in the reverse direction giving rise to a circular flow.

Thus, product flow from the seller to the buyer is necessarily a complement of money (income) flow from the buyer to the seller. Money flow is the reciprocal (opposite) of real flow when money is used as a medium of exchange.

E. Long-answer questions-II (answer in 130-200 words)

1. Explain the circular flow of income in an economy.

Answer: The circular flow of income refers to the continuous circular flow of goods, services, and money among different sectors of the economy. In an economy, there are two sectors, namely Household Sector and Firm Sector. Firms hire/purchase factor services from households and by coordinating them produce goods and services and thereby generate income. Households as owners of factors of production (land, labour, capital and enterprise) receive the payment in terms of money (rent, wages, interest and profit) as reward for rendering productive services. Thus, income is generated.

The recipients of these incomes (i.e., factor owners or households) in turn spend their incomes on purchase of goods and services (produced by firms) to satisfy their wants. Consumption expenditure by households is reverse flow of income going back to firms. This makes the circular flow of income complete.

The circular flow of income involves two basic principles:

(i) In any exchange process, the seller (or producer) receives the same amount which the buyer (or consumer) spends.

(ii) Goods and services flow in one direction and the money payment to acquire them, flows in the reverse direction giving rise to a circular flow.

Thus, product flow from the seller to the buyer is necessarily a complement of money (income) flow from the buyer to the seller. Money flow is the reciprocal (opposite) of real flow when money is used as a medium of exchange.

2. Discuss the circular flow of income in a two-sector economy.

Answer: In a two-sector economy, which includes the household sector and the firm sector, the circular flow of income refers to the continuous circular flow of goods, services, and money. The firm sector hires factor services from households who are owners of factors of production (land, labour, capital, and enterprise) for producing goods and services and pays them remuneration (or compensation) in the form of money for rendering the productive services.

These factor incomes are known as rent, wages, interest, and profit which have been generated in the production process. Thus, money income flows from the firm sector to the households. With this money, the households purchase from the firms, manufactured goods and services to satisfy their wants with the result that the same money flows back from households to the firm sector. Thus, the entire income of the economy comes back to firms in the form of sale revenue.

This circular flow of income and product involves two basic principles:

(i) In any exchange process, the seller (or producer) receives the same amount which the buyer (or consumer) spends.

(ii) Goods and services flow in one direction and the money payment to acquire them, flows in the reverse direction giving rise to a circular flow.

Thus, product flow from the seller to the buyer is necessarily a complement of money (income) flow from the buyer to the seller. Money flow is the reciprocal (opposite) of real flow when money is used as a medium of exchange.

Additional/extra questions and answers

Coming soon

Additional/extra MCQs

Coming soon

Get notes of other classes and subjects

| NBSE | SEBA/AHSEC |

| NCERT | TBSE |

| WBBSE/WHCHSE | ICSE/ISC |

| BSEM/COHSEM | MBOSE |

| Share Feedback | Question Papers |