Here, you will find summaries, questions, answers, textbook solutions, pdf, extras etc. of (Nagaland Board) NBSE Class 12 (Arts/Commerce) Economics Chapter 5: Aggregate Demand and its Component. These solutions, however, should be only treated as references and can be modified/changed.

Introduction

In macroeconomics, two fundamental concepts are aggregate demand and aggregate supply. These concepts are the backbone of economic analysis, providing a comprehensive view of economic activity at a national level.

Aggregate demand refers to the total demand for final goods and services in an economy within a specific time frame. It comprises various components, including household consumption demand, private investment demand, government demand for goods and services, and net export demand. Each of these components plays a crucial role in shaping the overall demand in an economy.

On the other hand, aggregate supply represents the total output of goods and services produced for sale in an economy. It is the money value of total output available for purchase during a given period. The main components of aggregate supply are consumption and saving. A significant portion of income is spent on consumption of goods and services, and the balance is saved.

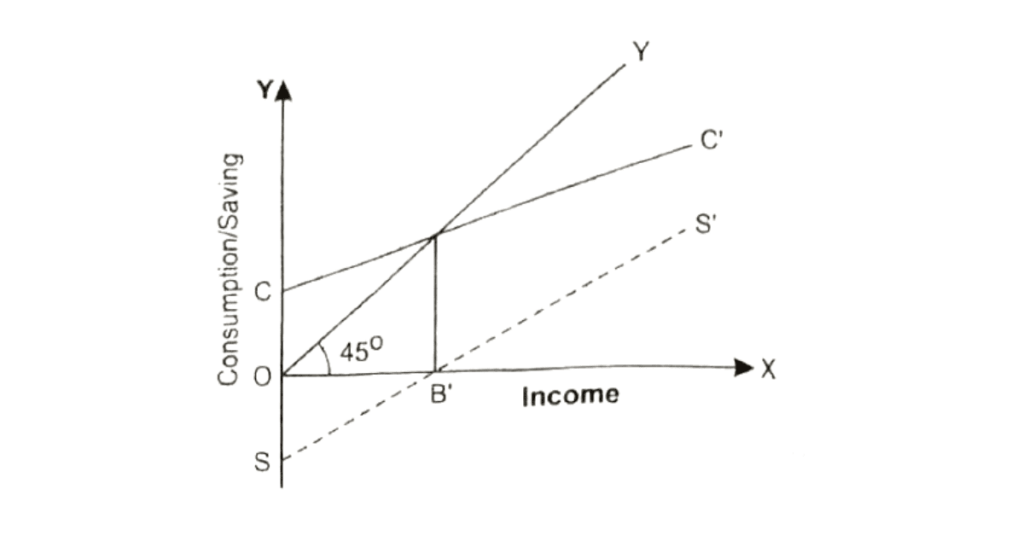

The relationship between consumption and income is known as the consumption function or propensity to consume. As income increases, consumption expenditure also increases, but the increase in consumption is less than the increase in income. This relationship is crucial in understanding the spending behavior of consumers in an economy.

Similarly, the saving function represents the relationship between saving and income. The part of income not spent on current consumption is saved. As income increases, the propensity to save also increases.

Textual questions and answers

A. Very short-answer questions

1. Consumption function is the functional relationship between ___________ and __________.

Answer: consumption, income

2 . What does C/Y indicate?

Answer: Average Propensity to Consume (APC)

3. The ratio of change in consumption to change in income is called ___________.

Answer: Marginal Propensity to Consume (MPC)

4. What is the shape of AD curve?

Answer: upward sloping

8. What assumption is Keynesian theory of employment based on?

Answer: Keynesian theory of employment is based on the assumption of less than full employment in the economy.

9. What s Breakeven Point?

Answer: Break-even Point refers to that point in the level of income at which consumption expenditure becomes exactly equal to income.

10. When planned savings exceed planned investment, the level of income and employment will tend to ___________.

Answer: fall

B. Short-answer questions-I

1. What are the two approaches to macroeconomics?

Answer: The two approaches to macroeconomics are the Classical Theory and the Keynesian Theory. The Classical Theory assumes full employment in the economy, while the Keynesian Theory criticizes this assumption and instead focuses on the determination of income, employment, and output at a level lower than full employment.

2. What are the components of aggregate demand?

Answer: The components of aggregate demand (aggregate expenditure) in a four-sector economy are:

- Household (or private) consumption demand (C)

- Private investment demand (I)

- Government demand for goods and services (G)

- Net export demand (X-M)

3. Define aggregate supply.

Answer: Aggregate supply is the money value of total output available in the economy for purchase during a given period.

4. What are the components of aggregate supply?

Answer: The main components of aggregate supply are consumption and saving.

5. State the consumption function.

Answer: The consumption function is represented by the equation C = C + bY, where C is total consumption, C is autonomous consumption (i.e., consumption at zero level of income), b is the Marginal Propensity to Consume (i.e., the rate at which consumption increases for every rupee increase in income), and Y is the level of income.

6. What is autonomous consumption?

Answer: Autonomous consumption is the consumption that occurs even when income is zero. It is the minimum level of consumption that has to be maintained for survival.

7. How is autonomous consumption different from induced consumption?

Answer: Autonomous consumption is different from induced consumption in that autonomous consumption is the minimum level of consumption that occurs even when income is zero, while induced consumption is the additional consumption that occurs when income increases. Induced consumption is less than additional income, meaning that when income increases, consumption expenditure does not increase at the same rate as income. This is known as induced consumption.

13. What is autonomous investment?

Answer: Autonomous investment refers to an investment which is autonomous (independent) of the level of income and not influenced by profit expectation. It is generally done in the government sector. It is income-inelastic, i.e., it is not affected by change in income level.

14. What is induced investment?

Answer: Induced investment refers to the investment which is made with the motive of earning profit and is directly influenced by income level. Private investment is almost induced investment.

C. Short-answer questions-II

1. Write a short note on aggregate demand.

Answer: Aggregate demand refers to the total demand for all goods and services in an economy at a given price level and in a given time period. It is the sum of all personal consumption expenditures (C), investments (I), and government spending (G), plus the difference between the country’s exports (X) and imports (M). It is represented as AD = C + I + G + (X-M). Aggregate demand curve slopes downwards due to the wealth effect, interest rate effect, and international trade effect.

2. What is meant by aggregate supply? What are its components?

Answer: Aggregate supply is the money value of total output available in the economy for purchase during a given period. When expressed in physical terms, aggregate supply refers to the total output of goods and services produced for sale in an economy. It is assumed that in the short run, prices of goods do not change and the elasticity of supply is infinite.

The main components of aggregate supply are consumption and saving.

3. What is APC? Give its features.

Answer: Average Propensity to Consume (APC) is the ratio of total consumption expenditure to total income. It gives the average consumption-income relationship at different levels of income. It is worked out by dividing total consumption expenditure (C) by total income (Y).

Features of APC include:

- APC can be greater than 1 when consumption expenditure is more than income

- APC can be less than 1 when consumption expenditure is less than income

- APC can never be zero because at zero income, survival needs minimum consumption (called Autonomous Consumption)

- APC falls with an increase in income.

4. What is MPC? Write its features.

Answer: Marginal Propensity to Consume (MPC) is the ratio of change in consumption due to change in income. It measures the ratio of change in consumption expenditure as a result of change in income.

Features of MPC include:

- MPC is always greater than zero but less than 1

- MPC falls with an increase in income

- MPC is assumed to be constant for a straight line consumption curve

- MPC is graphically the slope of the consumption curve

9. What is the relationship between APS and APC?

Answer: The sum of APC and APS is always equal to unity (i.e., APC + APS = 1). It is so because income is either consumed or saved. Again, the relationship can be stated in the following way as well: APC = 1 – APS and APS = 1 – APC. If one is given, the other can be worked out. Again, the value of APS can be negative when consumption expenditure exceeds income. When income increases, APC decreases continuously but APS increases continuously.

10. What is the relationship between MPS and MPC?

Answer: The sum of MPC and MPS is equal to unity (i.e., MPC + MPS = 1). For instance, if a person’s income increases by 1 and out of it, they spend 70 paise on consumption (i.e., MPC = 0.7) and save 30 paise (i.e., MPS = 0.3), then MPC + MPS = 0.7 + 0.3 = 1. This relationship can also be expressed as MPC = 1 – MPS and MPS = 1 – MPC. If one is given, we can find out the other because the sum of MPC and MPS is equal to unity, i.e., incremental (additional) income.

D. Long-answer questions-I

1. Explain in detail aggregate demand and its components.

Answer: Aggregate demand refers to the total demand for final goods and services in the economy. It includes Household (or private) consumption demand, Private investment demand, Government demand for goods and services, Net export demand. Household (or Private) Consumption Demand (C) is defined as ‘Value of goods and services that households are able and willing to buy. Private Investment Demand (I) refers to planned (ex-ante) expenditure on the creation of new capital assets like machines, buildings, and raw materials by private entrepreneurs. Government Demand for Goods and Services (G) refers to government planned (ex-ante) expenditure on the purchase of consumer and capital goods to fulfill common needs of the society. Net Exports (Exports- Imports) Demand is the difference between the export of goods and services and import of goods and services during a given period.

2. Write a note on the consumption function.

Answer: The consumption function, or propensity to consume, is the functional relationship between consumption and income. Consumption, being a part of income, directly depends upon income itself. Thus, consumption (C) is a function (f) of income (Y). Symbolically: C=f(Y). The consumption function means the proportion of income spent on consumption goods.

The consumption function (linear, i.e., straight-line consumption function) is represented by the following equation: C=C+bY. Here, C is total consumption, C is autonomous consumption (i.e., consumption at zero level of income), b is the Marginal Propensity to Consume — MPC (i.e., the rate at which consumption increases for every rupee increase in income), and Y is the level of income.

3. Write a note on APC and MPC.

Answer: Average Propensity to Consume (APC): The ratio of total consumption expenditure to total income is called APC. It gives the average consumption-income relationship at different levels of income. It is worked out by dividing total consumption expenditure (C) by total income (Y). APC can be greater than 1 when consumption expenditure is more than income. APC can be less than 1 when consumption expenditure is less than income. APC can never be zero because at zero income, survival needs minimum consumption (called Autonomous Consumption). APC falls with an increase in income.

Marginal Propensity to Consume (MPC): The ratio of change in consumption (ΔC) due to change in income (ΔY) is called MPC. MPC is that part of additional income which is spent on additional consumption. The value of MPC is equal to unity (i.e.,1) when MPS is zero since the whole of disposable income is spent on consumption. Again, the value of MPC cannot be greater than 1 because change in consumption (i.e., additional consumption) cannot be more than change in income (i.e., additional income).

4. What do you mean by break-even point? Explain with the help of an example.

Answer: The break-even point refers to the point at which total cost equals total revenue, resulting in neither profit nor loss.

For instance, if a company sells a product for Rs 20 per unit, and the total fixed costs are Rs 1000, and the variable cost per unit is Rs 10, then the break-even point in units would be 100. This means the company needs to sell 100 units of the product to cover its total costs. If it sells less than 100 units, it will incur a loss, and if it sells more than 100 units, it will make a profit

5. Explain the meaning of MPS and its features with an example.

Answer: MPS, or Marginal Propensity to Save, is the ratio of change in saving (ΔS) to change in income (ΔY). It is that part of additional income which is saved. In other words, it is a measure of additional Saving as a proportion of additional (incremental) income. MPS is worked out by dividing change in saving (ΔS) with the corresponding change in income (ΔY).

For instance, when national income goes up from < 100 crore to € 200 crore, saving also goes up from zero to % 30 crore. In this case, MPS = ΔS / ΔY = 30 / 100 = 0.3 or 30%.

Features of MPS include:

(i) Value of MPS lies always between 0 and 1. If entire additional income is consumed, then there is no saving making MPS = 0. If entire additional income is saved, then MPS = 1. (ΔS=ΔY) In short,0< MPS <1.

(ii) MPS (like MPC) can never be negative because MPS is the ratio between additional saving (ΔS) and additional (incremental) income (ΔY)

8. Differentiate between induced investment and autonomous investment?

Answer: Induced investment refers to the investment which is made with the motive of earning profit and is directly influenced by income level. Private investment is almost always induced investment. Induced investment depends directly upon profit expectations. It is income-elastic, i.e., it changes as income changes. If national income goes up, induced investment also goes up, i.e., an increase in income induces investment.

On the other hand, autonomous investment refers to the investment which is autonomous (independent) of the level of income and not influenced by profit expectation. It is generally done in the government sector. It is income-inelastic, i.e., it is not affected by change in income level. The volume of autonomous investment is the same at all levels of income. Autonomous investment is generally affected by autonomous factors (other than income) such as public utility works, changes in the nature of consumer demand, increase in population, discovery of new resources, new technology, etc.

E. Long-answer questions-II

1. What is aggregate demand? What are its components?

Answer: Aggregate demand refers to the total demand for final goods and services in the economy. It is measured by the total expenditure of the community on goods and services, therefore, aggregate demand is also defined as the ‘total amount of money which all sectors (households, firms, government) of the economy are ready to spend on the purchase of goods and services. Alternatively, it is the total expenditure which the community intends to incur on the purchase of goods and services during the year.

The main components of aggregate demand (aggregate expenditure) in a four-sector economy are:

- Household (or private) consumption demand (C): It is defined as the ‘Value of goods and services that households are able and willing to buy.’ It refers to ex-ante (planned) consumption expenditure to be incurred by all households on the purchase of goods and services.

- Private investment demand (I): This refers to planned (ex-ante) expenditure on the creation of new capital assets like machines, buildings, and raw materials by private entrepreneurs.

- Government demand for goods and services (G): It refers to government planned (ex-ante) expenditure on the purchase of consumer and capital goods to fulfill common needs of the society.

- Net export demand (X-M): Net export is the difference between the export of goods and services and the import of goods and services during a given period.

2. What is the relationship between income and saving? Explain.

Answer: The relationship between income and saving is direct, meaning that if income increases, saving also increases, but by less than the increase in income. This implies that as income increases, the proportion of income saved increases because the proportion of income consumed decreases.

At a lower level of income, saving can be negative. In the initial stages when there is a very low level of income, consumption expenditure is more than income, leading to negative saving (i.e., dissaving).

The saving function curve, which is a diagrammatic representation of the relationship between income and savings level, depicts a direct relationship between income and saving. The savings function line cuts the income line at a point called the Break-even point because at this point consumption expenditure is equal to income (or savings are zero). To the left of the break-even point, savings are negative, indicating consumption being more than income. To the right of the break-even point, savings are positive, indicating consumption expenditure being less than income.

The sum of Average Propensity to Consume (APC) and Average Propensity to Save (APS) is always equal to unity (i.e., APC + APS = 1). This is because income is either consumed or saved. If one is given, the other can be worked out. Again, the value of APS can be negative when consumption expenditure exceeds income. When income increases, APC decreases continuously but APS increases continuously.

3. What is savings function? Derive the savings curve from the consumption curve.

Answer: The savings function refers to the relationship between income and savings. As income increases, savings also increase but by less than the increase in income. This means that as income increases, the proportion of income saved increases because the proportion of income consumed decreases. At a lower level of income, saving is negative. In the initial stages when there is a very low level of income, consumption expenditure is more than income leading to negative saving (i.e., dissaving).

The savings curve can be derived from the consumption curve as they are complementary curves. We know that consumption (C) + saving (S) is always equal to income (Y) because income is either consumed or saved. It implies that consumption and saving curves are complementary curves as Y = C + S. Therefore, we can derive the saving function or curve directly from the consumption function or curve.

6. Differentiate between

(i) Planned savings and Actual savings.

Answer: Planned savings, also known as ex-ante savings, are the savings which all the households plan (desire) to make at different levels of income during a period. The amount of planned savings is given by the saving function (i.e., propensity to consume). On the other hand, actual savings, also known as ex-post savings, refer to the actual amount of savings made in the economy during a period. In other words, realized savings of a period, say a year, are called actual (ex-post) savings.

(ii) Ex-Ante investment and Ex-Post investment.

Answer: Ex-ante investment, or planned investment, is the investment which is desired to be made by the firms and planners in the economy during a particular period in the beginning of the period. It is the amount of planned investment, given by the investment demand function (i.e. relation between investment demand and rate of interest).

Ex-post investment, or actual investment, of a period (e.g. a year), measured after the fact, is called actual or ex-post investment. It includes the investment of unsold goods which are referred to as unplanned investment. Thus, actual investment equals planned + unplanned investment. Sometimes investment is made which was not included in the planned (intended) investment. This type of investment is called unplanned investment. Unplanned investment takes place when unsold finished goods accumulate due to poor sales. Thus, actual investment of an economy is the total of planned investment and unplanned investment.

Additional/extra questions and answers

Coming soon

Additional/extra MCQs

Coming soon

Get notes of other classes and subjects